Please note that we may earn an affiliate commission if you make a purchase from our link.

About Divvy

Discover the revolutionary Divvy card – the free, tech-savvy credit card solution that has been causing a stir in the business world. But it’s not just about the credit card – Divvy provides a comprehensive funding solution with features like advanced budgeting software, virtual cards, rewards, and more. The question remains: does Divvy deliver on its promises, and is it the best choice for your business? Let’s explore and find out in this Divvy review.

Why You Should Trust Us

At our platform, we take great care in sourcing our reviews from a range of reputable and trustworthy sources. Our team thoroughly scours the internet for reviews from real customers who have purchased and used Divvy products, ensuring that we present a balanced and honest perspective.

To provide a comprehensive view of the Divvy shopping experience, we take into account various factors such as product quality, customer service, and delivery. Our goal is to give you a well-rounded understanding of what to expect when shopping with Divvy, so you can make an informed decision.

While we cannot guarantee that your experience will be identical to other customers, we believe that by presenting a variety of reviews, we can provide you with a fair and accurate representation of the Divvy shopping experience. Our team strives to maintain the highest level of integrity and impartiality in our reviews, so you can trust that our insights are reliable and unbiased.

You might also like: Intercom Review: 7 Reasons Why You Should Buy This Chatbot

Divvy Overview

Divvy is a cutting-edge financial technology platform that offers a comprehensive suite of financial management tools for businesses. With Divvy, businesses can streamline their financial operations and gain greater control over their spending.

Divvy’s platform includes a business credit card, expense management software, and accounts payable software. The credit card is no-cost and provides users with real-time transaction data and the ability to set limits and restrictions on employee spending. The expense management software allows users to track expenses and receipts, create budgets, and generate reports, while the accounts payable software streamlines invoice management and payment processing.

One of the standout features of Divvy is its virtual cards, which allow businesses to generate one-time use card numbers for online transactions, making it easier to manage subscriptions and online payments. Divvy also offers a rewards program that allows businesses to earn cashback on purchases made with the Divvy card.

Overall, Divvy is an all-in-one financial management solution that provides businesses with greater visibility and control over their spending, as well as powerful tools to streamline financial operations. With its innovative platform, Divvy is revolutionizing the way businesses manage their finances.

Here are some highlights of what Divvy has to offer:

- Comprehensive financial management tools

- Real-time transaction data

- Customizable spending limits

- Expense tracking and reporting

- Virtual cards

- Rewards program

- No-cost credit card

How Divvy Works

This innovative financial technology platform offers businesses a comprehensive suite of tools to streamline and simplify their financial management. With Divvy, you can say goodbye to the hassle and headaches of traditional financial management and hello to a more efficient and effective way of managing your finances. Here’s how Divvy works:

- Sign up – Businesses can sign up for Divvy online by providing basic information about their company and financial needs.

- Get approved – Once a business has signed up, Divvy reviews its information to determine eligibility for a Divvy account.

- Receive credit card – Once approved, businesses receive a Divvy credit card, which they can use for business expenses.

- Set spending limits and restrictions – Businesses can set customized spending limits and restrictions on employee spending using the Divvy platform.

- Make purchases – Employees can use the Divvy credit card to make purchases for the business, with real-time transaction data provided through the platform.

- Track expenses – Divvy’s expense management software allows businesses to track expenses and receipts, create budgets, and generate reports, providing greater visibility into their spending.

- Pay invoices – Divvy’s accounts payable software streamlines invoice management and payment processing, making it easier for businesses to manage their bills and pay vendors.

- Earn rewards – Divvy offers a cashback rewards program for businesses, providing an incentive to use the Divvy card for purchases.

Applying for Divvy is a breeze! Simply click the button below to go directly to the Divvy website. Once there, scroll down to the bottom of the page and click “Apply Now” to get started. There’s no need to request a demo, making the application process quick and easy. With Divvy’s suite of financial management tools at your fingertips, you can streamline your operations and manage your finances more effectively than ever before.

Divvy Features

| Features | Availability | Summary |

| Cards | ✔ | Unlimited number of physical and digital cards |

| Card Controls | ✔ | Set spending and financial restrictions, and monitor card activities |

| Card Benefits | ✔ | Standard Mastercard perks including rental vehicle insurance, MasterAssist medical services, and round-the-clock assistance |

| Spend Tracking | ✔ | Real-time expenditure information by department, team, project, or person is provided via budgeting software. |

| Bill Payment | ✖ | The Bill Pay function of Divvy is no longer accessible to new users, only to those who previously had it activated. |

| Mobile Apps | ✔ | On both iOS and Android devices, you may access your account on the move. |

Since you already know that Divvy offers a comprehensive platform to simplify business financial management, you must be curious right of what are Divvy’s features that people are praising about. Now, read on our review of Diivy features below:

- Business credit card – Divvy’s credit card is free to use, with no annual fees or interest charges. The card provides businesses with real-time transaction data and the ability to set limits and restrictions on employee spending.

- Expense management – Divvy’s expense management software allows businesses to track expenses and receipts, create budgets, and generate reports. This feature provides businesses with greater visibility into their spending, helping them to make more informed financial decisions.

- Accounts payable – Divvy’s accounts payable software streamlines invoice management and payment processing, making it easier for businesses to manage their bills and pay vendors.

- Virtual cards – Divvy’s virtual cards make it easy to manage subscriptions and online payments by generating one-time use card numbers for online transactions.

- Rewards program – Divvy offers a cashback rewards program for businesses, providing an incentive to use the Divvy card for purchases.

- Customizable spending limits and restrictions – Divvy allows businesses to set spending limits and restrictions on employee spending, giving them greater control over their finances.

- Real-time transaction data – With Divvy, businesses have access to real-time transaction data, allowing them to monitor spending and identify trends and patterns in their expenses.

Divvy’s suite of features provides businesses with a comprehensive financial management solution, offering tools to manage expenses, control spending, and streamline financial operations. With its innovative platform, Divvy is changing the way businesses handle their finances.

You might also like: Sucuri Review: Is Sucuri Worth It?

Divvy Pricing and Fees

Divvy is a free financial technology platform that provides businesses with powerful financial management tools, including a business credit card, expense management software, and accounts payable software. Here’s a breakdown of the pricing and fees associated with using Divvy:

- Business credit card – Divvy’s credit card is free to use, with no annual fees or interest charges.

- Expense management software – Divvy’s expense management software is also free to use.

- Accounts payable software – Divvy’s accounts payable software is free to use for businesses that pay their vendors by ACH transfer. For businesses that require check payments, there is a fee of $0.99 per check.

- Virtual cards – Divvy’s virtual cards are also free to use.

- Cashback rewards – Divvy offers a cashback rewards program for businesses, with rewards ranging from 1% to 7% on eligible purchases.

While Divvy doesn’t charge any upfront fees, it’s worth noting that the platform does charge foreign transaction fees for frequent travelers. These fees include cross-border fees of 0.90% of total transaction volume for US-based account users and 0.20% for Canada-based accounts, as well as a currency conversion fee of 0.20% of total transaction volume, regardless of where the account user is based.

In addition to these foreign transaction fees, Divvy also charges late payment fees of 2.99% or $38, whichever is greater. It’s important to note that Divvy does not publicly disclose its foreign transaction fees or late payment fees on its website, which is unfortunate.

Divvy Eligibility and Requirements

To use Divvy, businesses are required to have a US-based bank account and a US EIN.

While Divvy doesn’t publicly list what types of businesses are eligible to apply for its unsecured lines of credit, the platform is designed to suit small-to-mid-sized businesses. However, Divvy has recently started accepting sole proprietors, in addition to corporations and LLCs, so businesses of just about every type are now eligible for the service. Divvy also notes that an international company may sign up if at least one owner with 25% ownership or more is a US citizen or resident.

If a business doesn’t qualify for an unsecured line of credit with Divvy, they can still use the platform through its Credit Builder program. This program allows businesses with less-than-stellar credit to pay a security deposit that establishes the amount of their credit line.

While Divvy could be more transparent on its website regarding eligibility requirements for its unsecured lines of credit, we’re pleased to see that the platform has opened up its service to a wider variety of businesses through the Credit Builder program. With its powerful financial management tools and innovative features, Divvy is a valuable tool for businesses looking to streamline their financial operations and manage their expenses more efficiently.

You might also like: Atlas VPN Review – Features and Prices in 2023

Who Is Divvy For?

Here are some examples of who Divvy is for:

- Small business owners – Divvy’s easy-to-use platform and customizable spending limits make it an excellent choice for small business owners who want greater control over their spending.

- Medium-sized businesses – With its powerful expense management software and real-time transaction data, Divvy is a great option for medium-sized businesses looking to streamline their financial operations and gain greater visibility into their spending.

- Growing businesses – As businesses grow, managing expenses can become more challenging. Divvy’s platform is designed to scale with growing businesses, providing them with the tools they need to manage their finances more effectively.

- Businesses with multiple employees – Divvy’s platform allows businesses to give their employees access to the platform and to issue them their own virtual cards, making it easy to manage employee spending.

- Non-profit organizations – Divvy’s platform is a great option for non-profit organizations looking to manage their expenses more efficiently and gain greater visibility into their spending.

- Freelancers and independent contractors – Divvy’s virtual cards make it easy for freelancers and independent contractors to manage their expenses and keep track of their spending.

- Businesses with remote employees – Divvy’s platform is designed to be used on-the-go, making it an excellent choice for businesses with remote employees or those who travel frequently.

- Businesses with a high volume of transactions – Divvy’s real-time transaction data and powerful expense management software make it easy for businesses with a high volume of transactions to manage their finances more effectively.

Is Divvy Safe?

Yes, Divvy is safe to use. The platform takes several steps to ensure the security and privacy of its users, including:

- Data encryption – Divvy uses industry-standard encryption to protect users’ data, including SSL/TLS encryption for data in transit and AES-256 encryption for data at rest.

- Two-factor authentication – Divvy requires users to set up two-factor authentication to add an extra layer of security to their accounts.

- Real-time monitoring – Divvy’s platform is monitored 24/7 for any suspicious activity, with alerts sent to the security team if any unusual activity is detected.

- PCI compliance – Divvy is PCI compliant, meaning that the platform meets the security standards set by the Payment Card Industry Security Standards Council.

- Fraud detection – Divvy uses advanced tools to identify and prevent fraudulent transactions on its platform.

Overall, Divvy takes the security and privacy of its users very seriously and has implemented a range of measures to ensure that its platform is safe and secure to use. With its powerful financial management tools and innovative features, Divvy is valuable for businesses looking to manage their finances more efficiently and securely.

You might also like: Ivacy VPN Review: Is This VPN Worth It?

Our Verdict

Divvy is a comprehensive financial management platform that provides businesses with a suite of financial tools to streamline their financial operations. With its powerful suite of features, Divvy is changing the way businesses manage their finances. Although Divvy charges foreign transaction fees and could be more transparent about its eligibility requirements, it offers a Credit Builder program for businesses with less-than-stellar credit. Divvy prioritizes the privacy and security of its users, utilizing data encryption, two-factor authentication, real-time monitoring, PCI compliance, and fraud detection tools to protect user data. Overall, Divvy is a reliable and secure platform that can benefit businesses of all sizes looking to manage their finances more efficiently.

You might also like: iolo System Mechanic Review 2023: PC Optimization Solution

FAQ About Divvy

What is the purpose of Divvy?

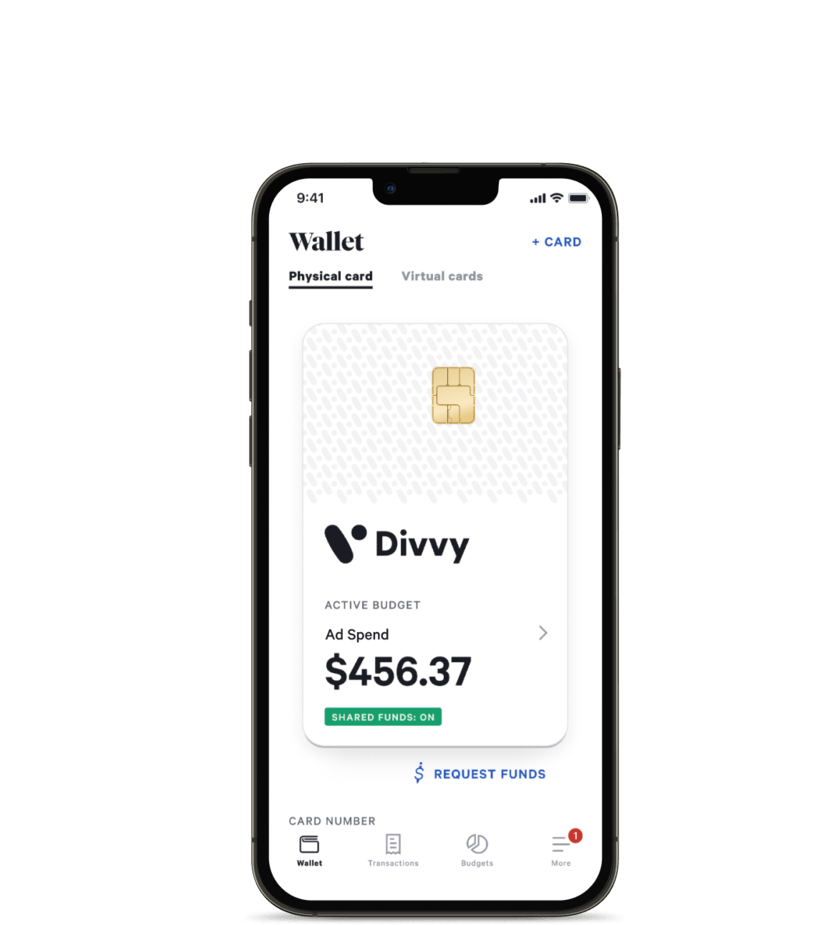

Divvy is a comprehensive financial management platform designed to simplify business expense management. It includes two primary components: physical and virtual cards, and expense management software that tracks spend from those charge cards. As a result, Divvy is an all-in-one solution that allows businesses to manage their expenses and control their spending efficiently. With its innovative platform, Divvy is transforming the way businesses handle their finances, providing greater control, efficiency, and savings.

Is Divvy available in Canada?

To be eligible for Divvy, companies must have a US bank account and a US EIN. However, international companies can still sign up if they have at least one owner who holds 25% ownership or more, is a US citizen or resident, and meets other requirements. By expanding its eligibility criteria to include international businesses, Divvy is offering its innovative financial management solutions to a broader range of companies, allowing them to streamline their operations and better manage their finances.

How do I pay with Divvy?

You may pay off your Divvy balance simply using the online platform’s payment gateway. If you are not at your workplace, you may make a payment from your mobile device. You may also pay by wire transfer, ACH deposit, or physical check.

Can you withdraw money from Divvy?

A Divvy card is a kind of credit card. You will not be given a pin, and you will not be able to withdraw money from this card at an ATM or earn cash back when you check out.

What bank does Divvy use?

Divvy cards are issued in collaboration with Cross River Bank of Ft. Lee, New Jersey. The bank, which was established in 2008, is a subsidiary of CRB Group, Inc.

How much money do you need for Divvy?

To be eligible for a Divvy card, your monthly company deposits must surpass $5,000.

Fun Fact!