About Online Check Writer

In today’s digital age, businesses require efficient and secure financial management tools to stay ahead of the competition. Online Check Writer is a leading fintech solution that aims to revolutionize the way businesses handle their finances. With its comprehensive suite of features and user-friendly interface, Online Check Writer provides a seamless platform for streamlining financial operations, ensuring accuracy, and saving valuable time.

Managing finances can often be a daunting and time-consuming task for businesses of all sizes. Traditional check writing and payment processes can be prone to errors, delays, and security risks. This is where Online Check Writer steps in, offering a powerful solution that simplifies and automates these critical financial tasks.

Learn more about it in this Online Check Writer review, where we dive deep into its background, how Online Check Writer works, its features, pros & cons, and pricing.

So, without further ado, let’s get into it!

Why You Should Trust Us

When it comes to making decisions about financial management solutions for your business, trust is paramount. We understand that you rely on accurate and unbiased information to choose the right platform that will streamline your operations and contribute to your success. That’s why we assure you that our Online Check Writer review is a trustworthy source that you can confidently rely on.

Our team of experienced professionals has meticulously researched and evaluated Online Check Writer to provide you with an insightful and comprehensive review. We have analyzed the platform’s features, functionalities, and user experiences to ensure that our review reflects an in-depth understanding of what OnlineCheckWriter has to offer.

Our commitment to impartiality is at the core of our review process. We do not have any vested interests or affiliations with Online Check Writer or any other financial management platform. This allows us to present an unbiased assessment, highlighting both the strengths and limitations of OnlineCheckWriter to help you make an informed decision based on your specific business needs.

You might also like: Divvy Review: Everything About This Business Credit Card

Online Check Writer Overview

Online Check Writer is a forward-thinking financial technology solution that caters to all your business needs. With its cloud-based check printing software and comprehensive range of services, Online Check Writer offers a convenient and efficient way to manage your financial operations. From check printing to online banking, this innovative platform has you covered.

One of the standout features of Online Check Writer is its ability to instantly print checks on blank stock papers using a regular printer at your office or home. This eliminates the need for pre-printed checks and allows for on-demand check printing, saving you time and resources. The software ensures that the checks are securely created and meets all the necessary banking standards.

In addition to check printing, Online Check Writer enables you to seamlessly move money through various payment options. With free ACH, Wire, and e-checks, you can transfer funds without incurring any transaction fees. This flexibility provides convenience and cost savings, empowering you to manage your finances efficiently.

Online Check Writer’s online banking service, Zil, further enhances its offering by providing a free business checking account. The account comes with a compelling 1.5% cashback reward on every dollar spent using a Zil Visa card. This feature allows you to maximize your savings while enjoying the benefits of a business checking account. What sets it apart is the ability to open a US bank account online from anywhere in the world, providing you with US banking benefits without geographical limitations.

With Online Check Writer, you can pay and get paid instantly using a variety of payment options. Whether it’s one-time or recurring payments, the software facilitates transactions through ACH, Wire, checks, and e-checks. Additionally, the $1 checks by mail service via USPS and FedEx allows for efficient and secure payment delivery. On the receiving end, you can accept payments from clients or customers via e-checks, invoices, check drafts, and send paid forms, streamlining your accounts receivable process.

How Does Online Check Writer Work

Online Check Writer simplifies financial management processes through its cloud-based platform, which offers seamless check writing and payment processing capabilities. Here’s how OnlineCheckWriter works in three paragraphs:

🆒 Check Writing: Online Check Writer provides a user-friendly interface that allows businesses to create and print checks easily. Users can customize check templates with their company logo, banking information, and other necessary details. The platform eliminates the need for pre-printed checks by enabling users to print checks instantly on blank stock papers using a regular printer. This on-demand check printing feature saves time and resources for businesses.

🆒 Payment Processing: Online Check Writer offers various payment processing options to facilitate efficient and secure financial transactions. Users can send payments to vendors or payees using methods such as ACH transfers, wire transfers, e-checks, or traditional paper checks. The platform provides flexibility in choosing the most suitable payment method based on business needs and preferences. By streamlining the payment process, Online Check Writer helps businesses save time and minimize errors.

🆒 Integration and Reporting: Online Check Writer integrates with popular accounting software, enabling seamless synchronization of financial data. This integration allows for the automation of financial workflows, making it easier to track expenses, manage invoices, and reconcile payments. The platform also offers reporting and analytics features, providing businesses with valuable insights into their financial operations. Users can generate reports on check payments, payment history, expenses, and more, helping them make informed decisions and optimize their financial processes.

In conclusion, Online Check Writer simplifies financial management by offering a user-friendly platform for check writing and payment processing. The on-demand check printing feature, diverse payment options, integration with accounting software, and robust reporting capabilities make Online Check Writer an efficient solution for businesses looking to streamline their financial operations and enhance overall efficiency.

Online Check Writer Features

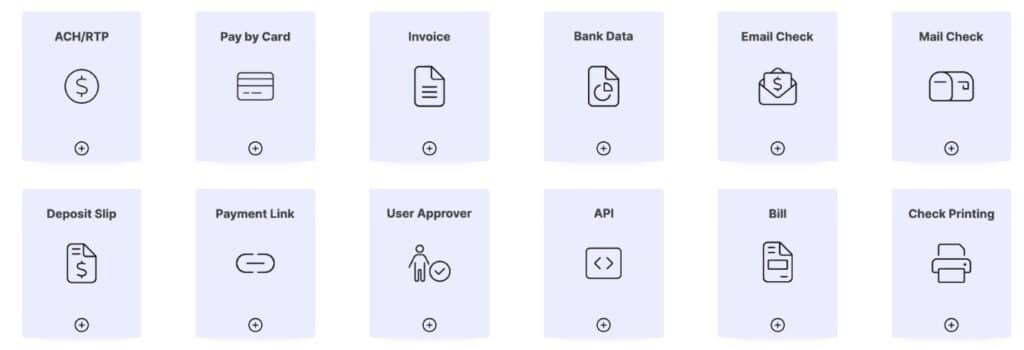

Online Check Writer offers a wide range of features to simplify and streamline financial management processes for businesses. Here are some key features of Online Check Writer:

🔝 Check Creation and Printing: Online Check Writer provides a user-friendly interface that allows businesses to create and customize professional-looking checks. Users can easily design check templates, add logos, and personalize the layout. The platform supports instant printing of checks on blank stock papers using a regular printer, eliminating the need for pre-printed checks.

🔝 Bank Integration: Online Check Writer integrates with over 16,000 banks, enabling direct and secure check payment without the need for manual deposits. This integration allows for seamless and efficient transfer of funds, reducing the administrative burden associated with traditional check processing.

🔝 Check Mailing Service: In addition to printing checks, Online Check Writer offers a convenient check mailing service. Users can opt for this service to outsource the process of printing, stuffing, and mailing physical checks. It saves time and effort by automating the check delivery process and ensuring timely and accurate payments.

🔝 Check Verification: Online Check Writer utilizes advanced MICR (Magnetic Ink Character Recognition) ink and font technology, ensuring the highest level of check security and preventing fraud. This feature makes it easy to verify the authenticity of checks and minimizes the risk of unauthorized alterations or counterfeit checks.

🔝 Check Drafting: Online Check Writer enables businesses to create and send digital checks, known as e-checks or check drafts. This feature offers a secure and efficient alternative to traditional paper checks, allowing for convenient payment processing and reducing reliance on physical documents.

🔝 Payment Processing Options: Online Check Writer offers multiple payment processing options to suit diverse business needs. Users can send payments to vendors or payees through methods such as ACH transfers, wire transfers, e-checks, and traditional paper checks. This flexibility enables businesses to choose the most convenient and cost-effective payment method for each transaction.

🔝 Reporting and Analytics: The platform provides robust reporting and analytics features, allowing businesses to gain insights into their financial data. Users can generate reports on check payments, payment history, expenses, and more, helping them track and analyze their financial transactions effectively.

These features collectively contribute to Online Check Writer’s goal of simplifying financial management processes and improving efficiency for businesses of all sizes. By offering a comprehensive suite of tools, OnlineCheckWriter helps businesses streamline check writing, payment processing, and financial reporting, saving time, reducing errors, and enhancing overall financial control.

You might also like: Keeper Security Review – 2023 Best Password Manager?

Online Check Writer Pros & Cons

Pros of Online Check Writer:

✅ Streamlined check writing process with instant printing on blank stock papers.

✅ Integration with over 16,000 banks for direct and secure check payment.

✅ Convenient check mailing service for outsourcing physical check delivery.

✅ Enhanced check security through MICR ink and font technology.

✅ Multiple payment processing options, providing flexibility for businesses.

✅ Seamless integration with popular accounting software for automated workflows.

Cons of Online Check Writer:

❌ Some advanced features require additional subscription plans.

❌ Limited customer support options.

❌ Potential for interface improvement to enhance user experience.

You might also like: Surfer SEO Review – Does It Boost The Organic Traffic?

Online Check Writer Review: What Do People Think?

Online Check Writer has garnered a positive reception from its users, with many expressing satisfaction with the platform’s capabilities and functionality. Users appreciate the streamlined check writing process, the convenience of instant check printing, and the integration with multiple banks for secure and direct payment. The ability to outsource check mailing services has also been well-received, as it saves businesses time and effort.

The advanced security features, such as MICR ink and font technology, have been praised for providing peace of mind and protecting against fraudulent activities. Users appreciate the various payment processing options available, allowing them to choose the most suitable method for their transactions. Additionally, the integration with popular accounting software has been recognized for its efficiency in automating financial workflows.

While the majority of users have had positive experiences with Online Check Writer, there have been some minor concerns. Some users have mentioned that certain advanced features require additional subscription plans, which may increase overall costs. Additionally, a few users have expressed a desire for improved customer support options and suggested further enhancements to the platform’s user interface for better usability.

Overall, the general consensus is that Online Check Writer is a reliable and efficient financial management solution that simplifies check writing, payment processing, and overall financial operations. Users appreciate the platform’s features, security measures, and integration capabilities, which contribute to increased productivity and accuracy in managing their finances.

Online Check Writer Plans & Pricing

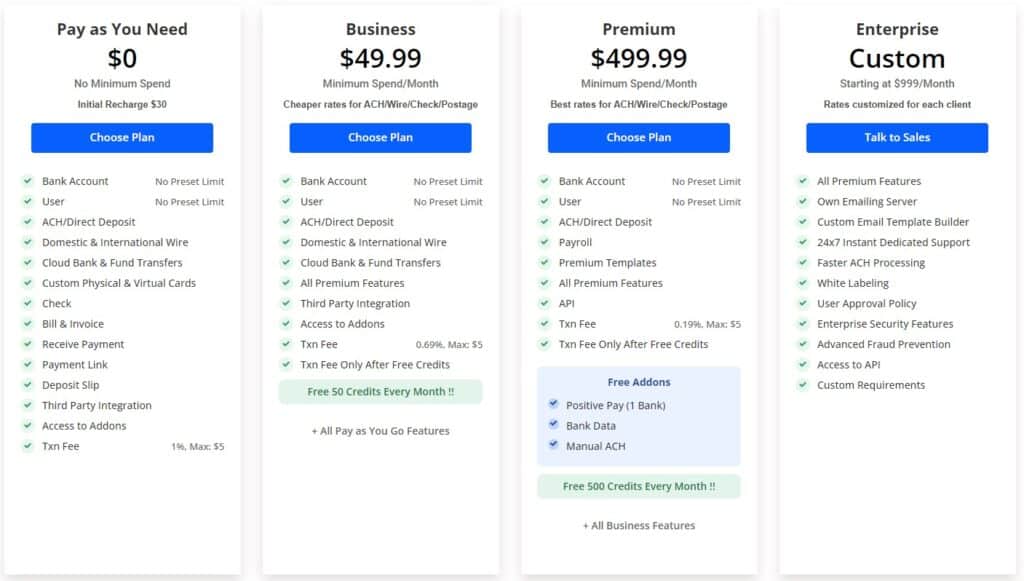

Online Check Writer offers different plans and pricing options to cater to the varying needs and budgets of businesses. Here is an overview of the available plans:

💸 Pay as You Need: This plan is designed for businesses with occasional check printing needs. It requires an initial recharge of $30, which can be used to cover the cost of printing checks. It offers flexibility, allowing users to pay for check printing on an as-needed basis.

💸 Business Plan: Priced at $49.99 per month, the Business plan is suitable for small to medium-sized businesses that require regular check printing and payment processing. It provides access to the core features of Online Check Writer, including check printing, bank integration, check mailing service, and check verification.

💸 Premium Plan: The Premium plan is priced at $499.99 per month and is tailored for larger businesses with higher check volumes and more complex financial operations. In addition to the features available in the Business plan, the Premium plan offers additional benefits such as priority customer support and advanced features for enhanced financial management.

💸 Enterprise Plan: The Enterprise plan is designed for large enterprises with extensive financial management needs. Pricing for the Enterprise plan starts at $999 per month and can vary depending on the specific requirements of the business. It offers a comprehensive suite of features, including customized solutions, dedicated account managers, and additional security measures.

It’s important to note that while the Pay as You Need plan and the Business plan have fixed pricing, the Premium and Enterprise plans may have customized pricing based on the specific needs of the business. It is recommended to contact Online Check Writer directly to discuss pricing options for the Premium and Enterprise plans.

By offering multiple plans, Online Check Writer aims to cater to businesses of various sizes and requirements. Each plan provides access to different features and levels of support, allowing businesses to choose the plan that best suits their needs and budget.

You might also like: HostPapa Review – Features, Pros & Cons, Pricing in 2023

Is Online Check Writer Worth It?

Determining if Online Check Writer is worth it for your business ultimately depends on your specific needs and circumstances. However, Online Check Writer offers several valuable features that can enhance financial management and streamline operations. The platform’s ability to simplify check writing, provide various payment processing options, and integrate with popular accounting software can save time, reduce errors, and improve efficiency.

Furthermore, Online Check Writer’s pricing plans cater to businesses of different sizes and needs, allowing you to choose the option that aligns with your budget. Consider the potential cost savings and increased productivity that Online Check Writer can provide compared to traditional check printing and payment management methods.

Ultimately, it is recommended to assess your business’s check writing and payment management requirements, evaluate the features and benefits of Online Check Writer, and consider the platform’s cost in relation to the value it can deliver. Exploring user feedback and taking advantage of any available trials or demos can also help inform your decision.

Fun Fact!

One fun fact about We Can Track is that it integrates with over 350 affiliate networks, which is like having the ability to speak and understand over 350 languages in the world of affiliate marketing! This extensive range of integrations allows users to seamlessly connect and manage a diverse array of affiliate campaigns, all from a single platform, making it a veritable polyglot in the digital marketing landscape.