About Simply Business

In the fast-paced world of business, protecting your venture from potential risks is crucial. Simply Business Insurance, although not an insurance provider itself, plays a vital role as a broker, connecting small-business owners with business insurance through its network of partner companies.

In this Simply Business review, we will explore Simply Business Insurance’s unique position in the market and the scope of its services for businesses in the United Kingdom and the United States.

Why You Should Trust

We prioritize providing unbiased and objective information. Our review is based on publicly available knowledge and data, allowing us to present a fair and balanced assessment of the subject matter.

Our review is conducted with thorough research and analysis. We strive to gather information from reputable sources, including well-established organizations, trusted experts, and credible industry publications. By employing a rigorous approach to our research process, we aim to deliver accurate and reliable information to our readers.

Simply Business Overview

Founded in 2005, Simply Business Insurance operates as a broker, serving as a bridge between small-business owners and insurance providers. While the company doesn’t directly underwrite policies or handle claims and customer service, it excels at streamlining the insurance process by gathering tailored quotes from its extensive network of insurance partners. By leveraging its relationships with insurers, Simply Business Insurance simplifies the task of finding appropriate coverage for small businesses.

Based in the United Kingdom, Simply Business Insurance benefits from its ownership by Travelers, one of the largest writers of commercial and small business insurance lines in the United States. This affiliation strengthens the company’s credibility and expertise in the insurance industry. While Simply Business Insurance predominantly offers a wide range of coverage options tailored to businesses in the UK, its offerings for US-based businesses are more limited.

You might also like: Divvy Review: Everything About This Business Credit Card

How Does Simply Business Work?

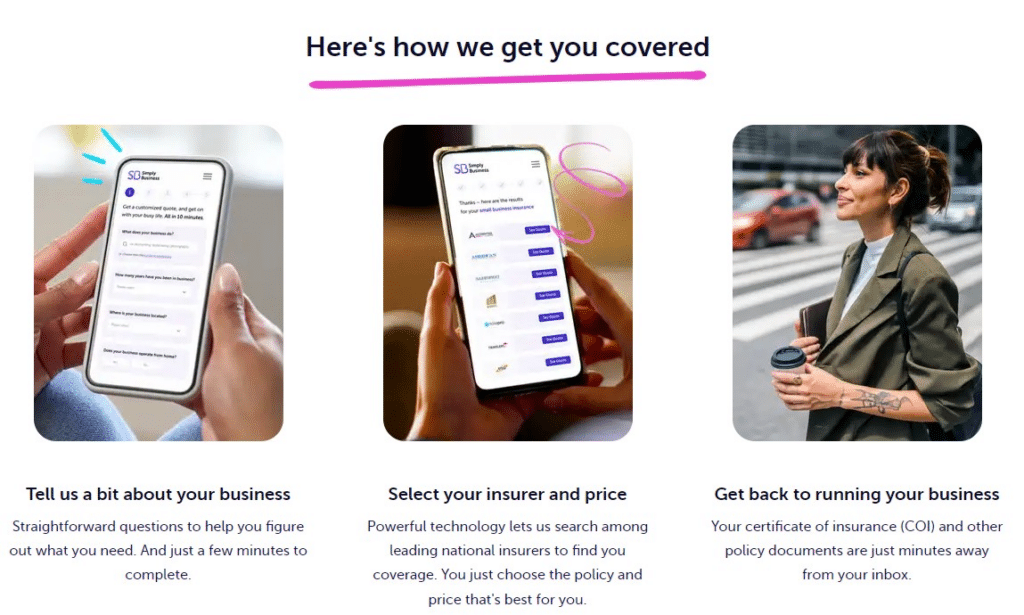

Simply Business operates as a broker, facilitating the process of obtaining business insurance for small and medium-sized businesses. Here is a breakdown of how Simply Business works:

1️⃣Initial Information: To get started, business owners provide basic information about their company, such as industry, size, and location. This information helps Simply Business understand the unique needs of the business and find appropriate coverage options.

2️⃣Network of Insurance Providers: Simply Business has established partnerships with a wide network of insurance providers. Leveraging these relationships, the company searches its network to obtain tailored quotes for the business owner based on their specific requirements.

3️⃣Quote Comparison: Once Simply Business gathers quotes from multiple insurance providers, they present the options to the business owner. The quotes include details such as coverage options, limits, deductibles, and pricing. This allows the business owner to compare and evaluate the different options to find the policy that best fits their needs and budget.

4️⃣Policy Purchase: After reviewing the quotes, the business owner can make an informed decision and select the policy that suits them best. Simply Business provides a seamless online platform where business owners can complete the purchase process, eliminating the need for paperwork and saving time.

5️⃣Policy Management: While Simply Business facilitates the initial stages of obtaining quotes and purchasing a policy, the ongoing management of the policy, including underwriting, claims processing, and customer service, is handled by the insurance provider issuing the policy. The business owner will interact directly with the insurer for any policy-related matters after the purchase.

6️⃣Customer Support: Simply Business offers customer support to assist business owners throughout the process. They have a dedicated customer service team available via phone and email to answer questions, provide guidance, and address any concerns that may arise during the insurance journey.

It’s important to note that Simply Business functions as a broker and not as an insurance provider. They connect businesses with insurance coverage through their network of partner companies, streamlining the process and providing businesses with access to a variety of insurance options. By simplifying the insurance journey, Simply Business aims to make it easier for small and medium-sized businesses to find the coverage they need to protect their operations.

You might also like: WPS Office Review 2023: Better than Microsoft Office?

Simply Business Types of Coverage

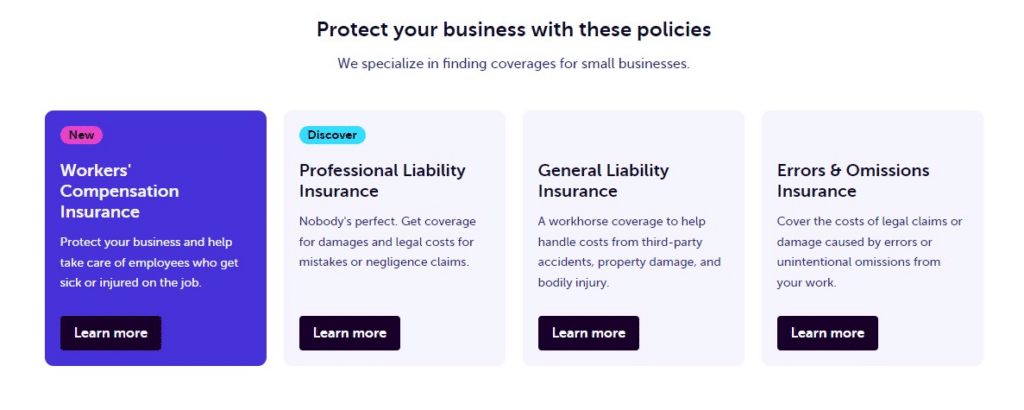

Simply Business offers a diverse range of coverage options through its network of partner insurance providers. Here is an overview of two key coverage types available:

🔝General Liability Insurance: Simply Business provides general liability insurance through several trusted partner providers. This coverage is highly recommended for virtually all business owners, as it safeguards against third-party claims of bodily injury, property damage, and other liabilities. In the event that your business is accused of libel, slander, or copyright infringement, general liability insurance steps in to provide protection.

It’s important to note that this coverage does not extend to damage to your own property or injuries sustained by your employees, as these areas are typically covered by commercial property and workers’ compensation insurance, respectively.

🔝Professional Liability Insurance: Also known as errors and omissions insurance, professional liability coverage is available through Simply Business’ network of insurance partners. This type of coverage proves invaluable if your business faces a lawsuit due to alleged negligence, mistakes, or delays in providing professional services.

Professional liability insurance not only covers legal fees but also provides financial protection against potential damages. This coverage is particularly essential for businesses that offer services or advice for a fee, including accountants, architects, consultants, engineers, and financial advisors.

Depending on your business type, Simply Business may also offer the option to add an errors and omissions endorsement to your general liability policy, rather than requiring the purchase of a separate professional liability policy.

By offering these coverage options, Simply Business ensures that business owners have access to the essential protection they need. Whether it’s general liability insurance to shield against potential lawsuits or professional liability insurance to mitigate risks associated with professional services, Simply Business aims to cater to the unique needs of different businesses. Consulting with a Simply Business representative or utilizing their online platform can help you determine the most suitable coverage options for your specific industry and circumstances.

You might also like: QuillBot Review: Is It 2023’s Best AI Paraphrasing Tool?

Simply Business Pros & Cons

Pros

Cons

- ✅ Wide partner network for access to diverse coverage options.

- ✅ Streamlined process for obtaining quotes and purchasing policies.

- ✅ Tailored coverage options for different industries and business types.

- ✅ Affiliation with Travelers adds credibility and expertise.

- ✅ Dedicated customer support for assistance throughout the insurance journey.

- ❌ Limited coverage options for US-based businesses.

- ❌ Claims and customer service handled by third-party insurers.

- ❌ Less direct control over policy terms and claims handling.

- ❌ Limited upfront information on partner providers.

- ❌ Potential variation in customer experience based on chosen insurer.

Simply Business Review: What Do Customers Think?

Gathering comprehensive customer reviews for Simply Business is a challenging task as it is a broker that connects customers with various insurance providers. However, it is worth considering the general sentiment and feedback associated with Simply Business based on available information.

It’s important to note that individual experiences and opinions may vary, as the ultimate customer experience can be influenced by the specific insurance provider selected through Simply Business. Factors such as claims handling, policy terms, and overall customer service may differ between insurance providers.

You might also like: Goaffpro Review – 2023’s Best Affiliate Marketing

Simply Business Price

The pricing of insurance coverage through Simply Business can vary depending on several factors, including the type of coverage, the size and nature of the business, industry-specific risks, and the selected insurance provider within their partner network.

As a broker, Simply Business connects businesses with insurance options from different providers, and each provider may have its own pricing structure.

To obtain accurate and up-to-date pricing information for your specific business and insurance needs, it is recommended to visit the Simply Business website or contact their customer support directly.

By providing details about your business and desired coverage, they can assist in obtaining quotes and providing pricing information from their network of insurance providers. This will allow you to compare options and make an informed decision based on your budget and coverage requirements.

Is Simply Business Worth It?

Determining if Simply Business is worth it depends on your specific business needs and preferences, especially if you are a small business owner.

Simply Business offers the convenience of a streamlined online platform, access to multiple insurance providers, and dedicated customer support.

If you value time savings, the ability to compare coverage options easily, and appreciate assistance throughout the insurance process, Simply Business can provide value. Their affiliation with Travelers also adds credibility and expertise to their services.

However, it’s important to note that Simply Business has limited coverage options for US-based businesses, which could be a drawback if you require specific types of coverage or have unique industry requirements.

Consider evaluating alternative options and comparing pricing and coverage from other providers to make an informed decision based on your business’s individual needs.